salary to afford 260k house

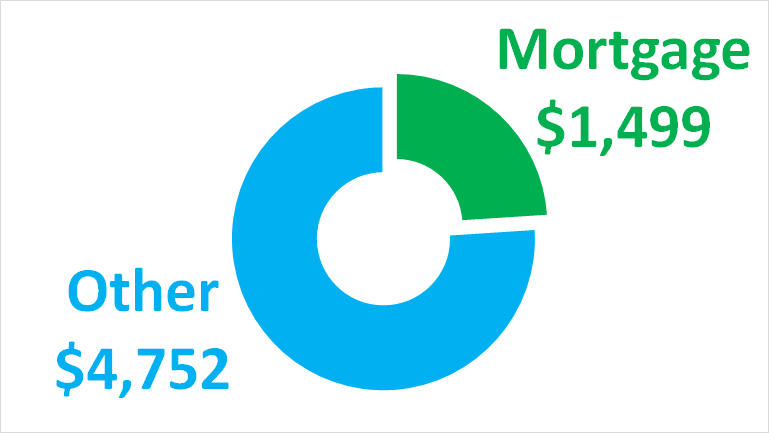

The monthly mortgage payment would be 1219. How we calculate how much house you can afford.

How Much House Can I Afford Moneyunder30

If you already have 50K then take that off.

. With a 45 percent interest rate and a 30-year term your. 415 11 votes A mortgage on 200k salary using the 25 rule means you could afford 500000 20000 x 25. A 60000 salary equates to a mortgage between 120000 and 150000.

Most home loans require a down payment of at least 3. Depends on area its usually between 1-3 for property tax and around 5 for insurance. 465 60 votes A mortgage on 200k salary using the 25 rule means you could afford 500000 20000 x 25.

With a 45 percent interest rate and a 30-year term your. This home affordability calculator provides a simple answer to the question How much house can I afford. There are a couple of important variables in the approval.

Your maximum mortgage payment Rule of 28 The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of. Ill give you a mortgage bankers answer to show you what you can qualify for. Figure around 1000-1500month for property tax insurance on 500k house.

The term afford is highly subjective. I dont think youd. Its how big your.

A salary of approximately 150k per year is needed to afford a 700k home. This is based upon the following assumptions down payment of 20 property taxes of 8k interest rate of 55 and other debt payments of 500 per month. So on your 60K salary you can take on a mortgage of 240-360K.

For a 260000 home a 20 down payment would be 52000. The amount of money you spend upfront to purchase a home. Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is.

To afford a house that costs 350000 with a down payment of 70000 youd need to earn 52225 per year before tax. At 200000 per year one. If you currently earn 200000 per year you may be surprised at the number of total square feet you could call home.

Depending on several factors you. Weve done the work to give you some insight. However this guideline is very conservative and usually exceeded by most homeowners.

The buyer of a home will usually be required to pay for an inspection closing costs and other fees during. Answer 1 of 7. But like any estimate its based on some rounded numbers and rules of thumb.

Thats ignoring how much you have saved for a deposit. If you have an annual salary of 120000 you should allocate around 2000 to 3000 per month for your housing costs. A 20 down payment is ideal to lower your monthly payment avoid.

Lenders like PITI principal.

How Much House Can I Afford Calculator Money

Over Half Of Seattle Homeowners Couldn T Afford Their Homes Now Says Report R Seattlewa

How Much House Can I Afford Fidelity

How Much House Can I Afford Home Affordability Calculator Hsh Com

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

I Make 75 000 A Year How Much House Can I Afford Bundle

This Is The Salary You Need To Afford A Home In California

:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_image/image/53348553/bungalows.0.jpg)

It Takes A Salary Of 98k To Afford A House In La Curbed La

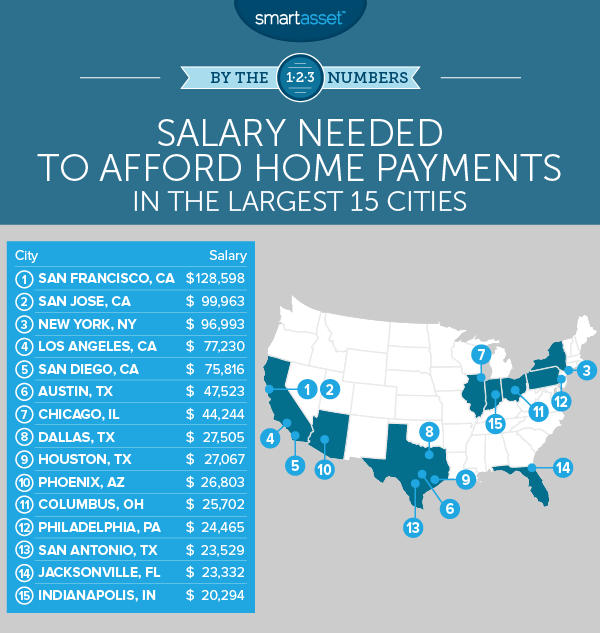

Salary Needed To Afford Home Payments In The 15 Largest Cities Smartasset

Can You Afford That House Consider Mortgage Interest More Los Angeles Times

The Salary You Must Earn To Buy A Home In The 50 Largest Metros

How Much Salary To Afford A 700k House Love Home Designs

How Much Money Do You Need To Buy A Home Credit Com

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/FMXUXOL4M5GNZACWLUFWEIUESM.jpg)

5 Ways To Calculate How Much House You Can Afford The Dough Roller

Why Households Need 300 000 To Live A Middle Class Lifestyle

Cost Of Living For Most Expensive House In Every State Apartment Therapy

Salary Needed To Afford Home Payments In The 15 Largest Cities Smartasset

Mortgage Income Calculator Nerdwallet

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator